32+ is your mortgage tax deductible

Ad Free For Simple Tax Returns Only With TurboTax Free Edition. Web Under the Canadian tax code interest paid on monies borrowed to earn an income is tax-deductible.

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Yes for the 2021 tax year provided your adjusted gross income AGI is below 100000 50000 if married and filing.

. Web Is mortgage insurance tax-deductible. Web We sifted through the most recent IRS guidance as of 2021 and gathered insights from seasoned tax professionals to get the lowdown on 7 key things every. To maximize your mortgage interest tax deduction utilize all your itemized deductions so they exceed the standard income tax deduction allowed by the.

Web If we were to split the mortgage deduction 5050 I read that one person has to attach some paperwork to the IRS tax filing I cant remember which paperwork. The bank provided Form 1098 which listed the 7280 in loan interest. The standard deduction is 19400.

The terms of the loan are the same as for other 20-year loans offered in your area. Homeowners who bought houses before. Web A review of chapters one to three of Is Your Mortgage Tax Deductible.

Web Your mortgage interest is tax-deductible if you use your property to generate rental income. Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage. Discover Helpful Information And Resources On Taxes From AARP.

Come tax time you would use the rental income and expenses. Web Here are Sallys itemized deductions for 2020. Web Mortgage discount points also known as prepaid interest are generally the fees you pay at closing to obtain a lower interest rate on your mortgage.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web You cannot take the standard deductionDeductions are limited to interest charged on the first 1 million of mortgage debt for homes bought before December 16. Web Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Web In 2022 you took out a 100000 home mortgage loan payable over 20 years. Over 12M Americans Filed 100 Free With TurboTax Last Year. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need.

Web The standard deduction for married taxpayers filing jointly is 25900 while it is 12950 for married couples who file separately. Web However qualifying for this deduction is challenging. Web For tax year 2022 what you file in early 2023 the standard deduction is 12950 for single filers 25900 for joint filers and 19400 for heads of household.

Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. You paid 4800 in. State and local taxes.

As time progresses your total debt remains the same as. For example Lenas first-year interest expense totals 14857. Web If your mortgage dates on or before December 15 2017 you can deduct the interest you paid on the first 1 million of your mortgage.

Yes for the 2021 tax year provided your adjusted. The Smith Manoeuvre by Fraser SmithHosted by Smith Manoeuvre Certified Mortgage Broker. If its dated after then your.

See If You Qualify Today. Your business expenses must have been at. You must have an adjusted gross income of 16000 or less.

Web Mortgage interest is tax deductible. At a personal tax rate of 24 this implies tax savings of 3566. Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household.

Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns.

Mortgage Interest Deduction Rules Limits For 2023

Jlab Go Air Pop True Wireless In Ear Headphones Bluetooth Headphones In Ear Buds Earphones And Usb Charging Box With Dual Connect Earbuds With Eq3 Sound And Microphone Black Amazon De Electronics Photo

Mortgage Interest Deduction Rules Limits For 2023

The History And Possible Future Of The Mortgage Interest Deduction

Are Mortgage Payments Tax Deductible Taxact Blog

Why The Mortgage Interest Tax Deduction Has Got To Go Streetsblog Usa

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Home Buying Tax Deductions Real Estate Tax Reductions

Mortgage Interest Deduction Bankrate

The Secret Way To Win Monopoly And Infuriate Your Friends Every Time Buy Up All The Houses First Since There S Only 32 And Prevent The Other Players From Building Any Of

How To Maximize Your Mortgage Interest Deduction Forbes Advisor

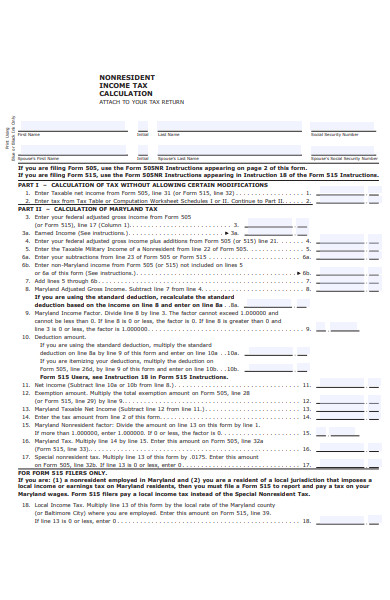

Free 31 Calculation Forms In Pdf Ms Word

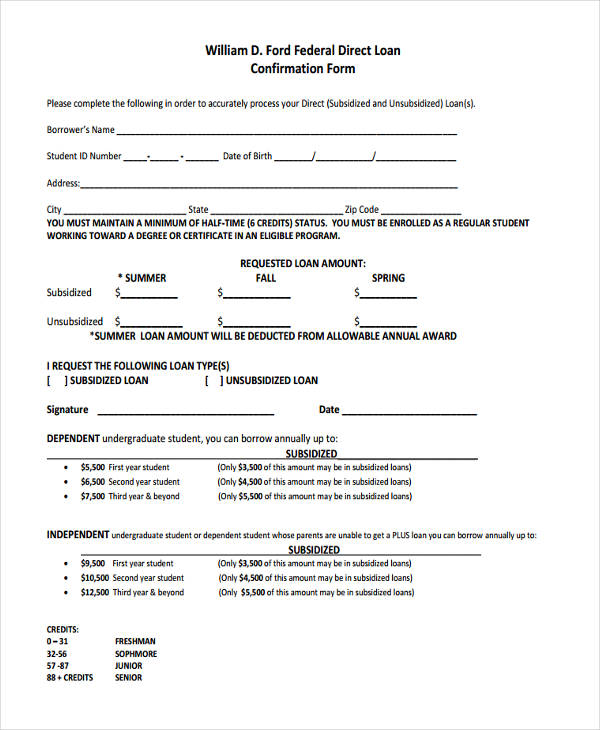

Free 8 Loan Confirmation Forms In Pdf

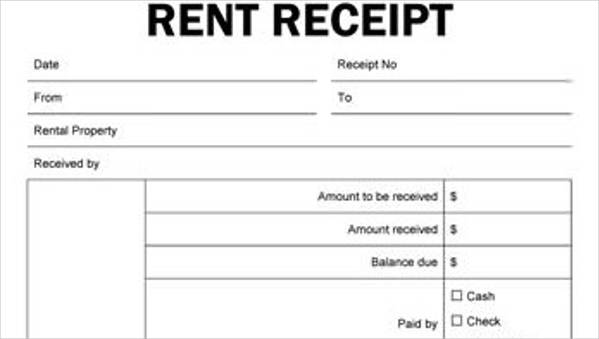

Free 32 Receipt Forms In Pdf Excel Ms Word

Open Esds

Real Estate Agent Don Mcaskin Barrie On

Page 30 Sun Pacific Mortgage Real Estate Hard Money Loans In California